Form W-4S

Get NowForm W-4S: The Explanation & Instructions

What is the purpose of the W-4S form?

The IRS W-4S form, also known as the "Request for Federal Income Tax Withholding from Sick Pay," is a document used by individuals who receive sick pay from their employer. This form is used to calculate the correct amount of federal income tax to be withheld from the individual's sick pay, and is typically completed by the individual receiving the sick pay.

How to complete the request

The W-4S form must be completed by individuals who are receiving sick pay, as well as their employers. The form includes several sections that must be filled out:

- Personal information:

- individual's name

- Social Security number

- address.

- Information about the sick pay:

- the amount of sick pay the person expects to receive

- the length of time the person will be receiving the sick pay.

The form must be filled out completely and accurately, as the information provided will be used to calculate the correct amount of federal income tax to be withheld from the individual's sick pay. The individual can claim exemptions from withholding and an additional amount on the form.

The main differences between the W-4 and the W-4S forms

One of the key differences between the W-4 and the W-4S forms is their purpose. The W-4 form is used for regular income, and the W-4S is for Sick Pay. Another difference is that the W-4S form will not have the concept of allowances like the W-4. This is because sick pay does not have the idea of additional exemptions.

In summary, the IRS W-4S form is a document used to calculate the correct amount of federal income tax to be withheld from an individual's sick pay. The form must be completed by the individual receiving sick pay and their employer. It includes sections for personal information, information about the sick pay, and options for withholding exemptions. The significant differences between the W-4 and W-4S form are the purpose, there is no concept of allowances in the latter. The form must be filled out completely and accurately to ensure the correct amount of tax is withheld.

Related Forms

-

![image]() W-4 The W-4 federal tax form is a document that U.S. taxpayers use to inform their employer of the appropriate amount of federal income tax to withhold from their paychecks. The form calculates the correct amount of tax withholding based on the employee's income, filing status, and the number of allowances claimed. The allowances claimed on the form determine the employee's tax liability, and the more benefits claimed, the less tax will be withheld from the pay. Filling out a W-4 form correctly is... Fill Now

W-4 The W-4 federal tax form is a document that U.S. taxpayers use to inform their employer of the appropriate amount of federal income tax to withhold from their paychecks. The form calculates the correct amount of tax withholding based on the employee's income, filing status, and the number of allowances claimed. The allowances claimed on the form determine the employee's tax liability, and the more benefits claimed, the less tax will be withheld from the pay. Filling out a W-4 form correctly is... Fill Now -

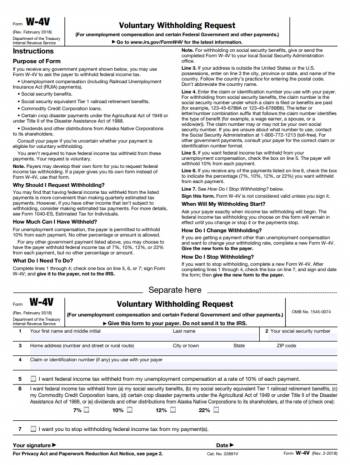

![image]() Form W-4V The purpose of IRS W-4V form The IRS W-4V form, also known as the "Voluntary Withholding Request," is a form that specific individuals can use to have taxes withheld from their government payments. The form requests that a particular dollar amount be withheld from each payment rather than having taxes withheld based on the number of allowances claimed on the standard W-4 form. Individuals who may need to file a W-4V form include those who receive government payments such as Social Security benefits, Veterans Affairs benefits, or railroad retirement benefits. These individuals may choose to withhold taxes from their payments to help prevent under-withholding and a large tax bill comes tax season. The W-4V form structure The W-4V form includes several sections for providing personal information, such as name, address, and social security number. It also includes a section specifying the dollar amount to be withheld from each payment, as well as indicating whether the individual wants to have taxes withheld from all payments or just some of them. It's important to note that the form must be filled out and submitted to the agency that issues the payment, whether it be the Social Security Administration, the Department of Veterans Affairs, or the Railroad Retirement Board. Differences between the W-4 and W-4V forms It is worth mentioning that the W-4V form is different from the W-4 form that employees use to have taxes withheld from their paychecks. The main difference is that the W-4V is voluntary and individuals decide to use it to withhold taxes from government payments. At the same time, the W-4 is mandatory for employees to have taxes withheld from their paychecks. To wrap up, here are a few key differences between the W-4 and W-4V forms: The W-4 form is used for employee payroll tax withholding, the W-4V is used for voluntary withholding from government payments The W-4 form is based on the number of allowances claimed, the W-4V form is based on a dollar amount specified by the individual The W-4 form is submitted to the employer, the W-4V form is submitted to the agency that issues the government payment. It's important for individuals who receive government payments to review their withholding status and make adjustments as necessary to ensure they don't end up owing taxes or getting a large refund come tax season. By understanding the W-4V form and when to use it, they can better manage their tax liabilities and plan accordingly. Fill Now

Form W-4V The purpose of IRS W-4V form The IRS W-4V form, also known as the "Voluntary Withholding Request," is a form that specific individuals can use to have taxes withheld from their government payments. The form requests that a particular dollar amount be withheld from each payment rather than having taxes withheld based on the number of allowances claimed on the standard W-4 form. Individuals who may need to file a W-4V form include those who receive government payments such as Social Security benefits, Veterans Affairs benefits, or railroad retirement benefits. These individuals may choose to withhold taxes from their payments to help prevent under-withholding and a large tax bill comes tax season. The W-4V form structure The W-4V form includes several sections for providing personal information, such as name, address, and social security number. It also includes a section specifying the dollar amount to be withheld from each payment, as well as indicating whether the individual wants to have taxes withheld from all payments or just some of them. It's important to note that the form must be filled out and submitted to the agency that issues the payment, whether it be the Social Security Administration, the Department of Veterans Affairs, or the Railroad Retirement Board. Differences between the W-4 and W-4V forms It is worth mentioning that the W-4V form is different from the W-4 form that employees use to have taxes withheld from their paychecks. The main difference is that the W-4V is voluntary and individuals decide to use it to withhold taxes from government payments. At the same time, the W-4 is mandatory for employees to have taxes withheld from their paychecks. To wrap up, here are a few key differences between the W-4 and W-4V forms: The W-4 form is used for employee payroll tax withholding, the W-4V is used for voluntary withholding from government payments The W-4 form is based on the number of allowances claimed, the W-4V form is based on a dollar amount specified by the individual The W-4 form is submitted to the employer, the W-4V form is submitted to the agency that issues the government payment. It's important for individuals who receive government payments to review their withholding status and make adjustments as necessary to ensure they don't end up owing taxes or getting a large refund come tax season. By understanding the W-4V form and when to use it, they can better manage their tax liabilities and plan accordingly. Fill Now